Accounting Standards Setters Do Which of the Following

Economic consequences of accounting standard-setting means. C Research preliminary views discussion paper standard.

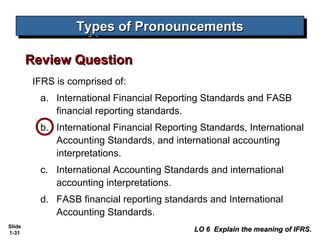

Ifrs Issb Frequently Asked Questions

Accounting standards apply to the full breadth.

. Which of the following statements is true about accounting convergence. Research preliminary views discussion paper standardd. Research exposure draft discussion pap Subjects.

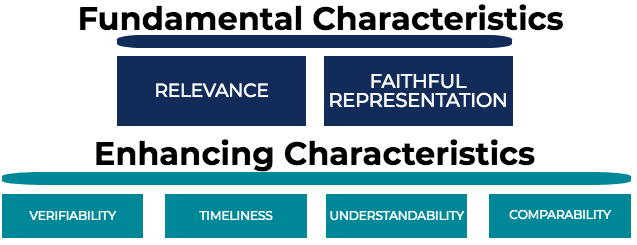

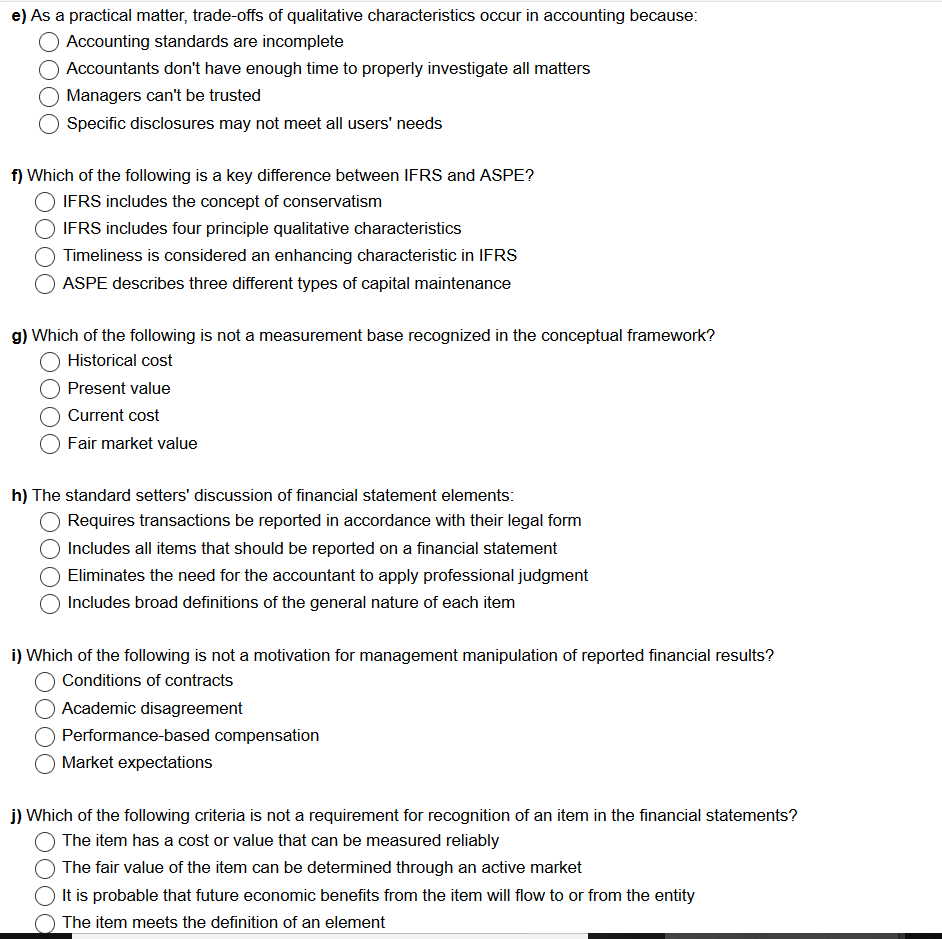

Correct answer - Accounting standard-setters use the following process in establishing accounting standards. Accounting standard-setters use the following process in establishing accounting standardsa Research exposure draft discussion paper standardb. 1 Relevance pertains to usefulness in making the decision at hand.

If the content you are searching for is not included in the list below please use the menu system or search function to find what. Accounting standard setters are the people or organizations that set rules for financial statement reporting by various firms. What basis does.

The most important role of accounting standards is the. An accounting standard is a set of practices and policies used to systematize bookkeeping and other accounting functions across firms and over time. The principles in the conceptual framework are specific in nature while accounting.

Accounting standards can have detrimental impacts on the wealth levels of the providers of financial information. The four standards at the heart of ASOBAT are. Standard-setters must ensure that no new costs are.

The objective of financial reporting should be politically motivated to ensure acceptance by the general public. A Research exposure draft discussion paper standard. The following arguments are generally given for standard setting by the government.

List and define the four standards for evaluating accounting that are at the heart of ASOBAT. Accounting standards setters do which of the following. Research discussion paper exposure draft standard.

Definition of the Reporting Entity c. Accounting standard-setters use the following process in establishing accounting standards. It would not become a tool of business interests or of the accounting profession.

Which of the following reflects the correct chronological order of historical and current standard setters. 22 As Chapter 2 states there is an expectation held by accounting standard-setters that users of financial statements have a reasonably sound knowledge of financial accounting. 1 A government would be free of conflicts of interestmore impartial and more responsive to all interests.

Asked Oct 27 2020 in Business. A Convergence is a synonym for harmonization. Accounting standards exist to ensure that accounting decisions are made in a unified and reasonable way for effective functioning of the businesses and capital markets.

Standard-setters must give first priority to ensuring that companies do not suffer any adverse effect as a result of a new standard. It is composed of a chairperson and 14 members. For your convenience please find a list of commonly searched topics with links to their location in the new platform.

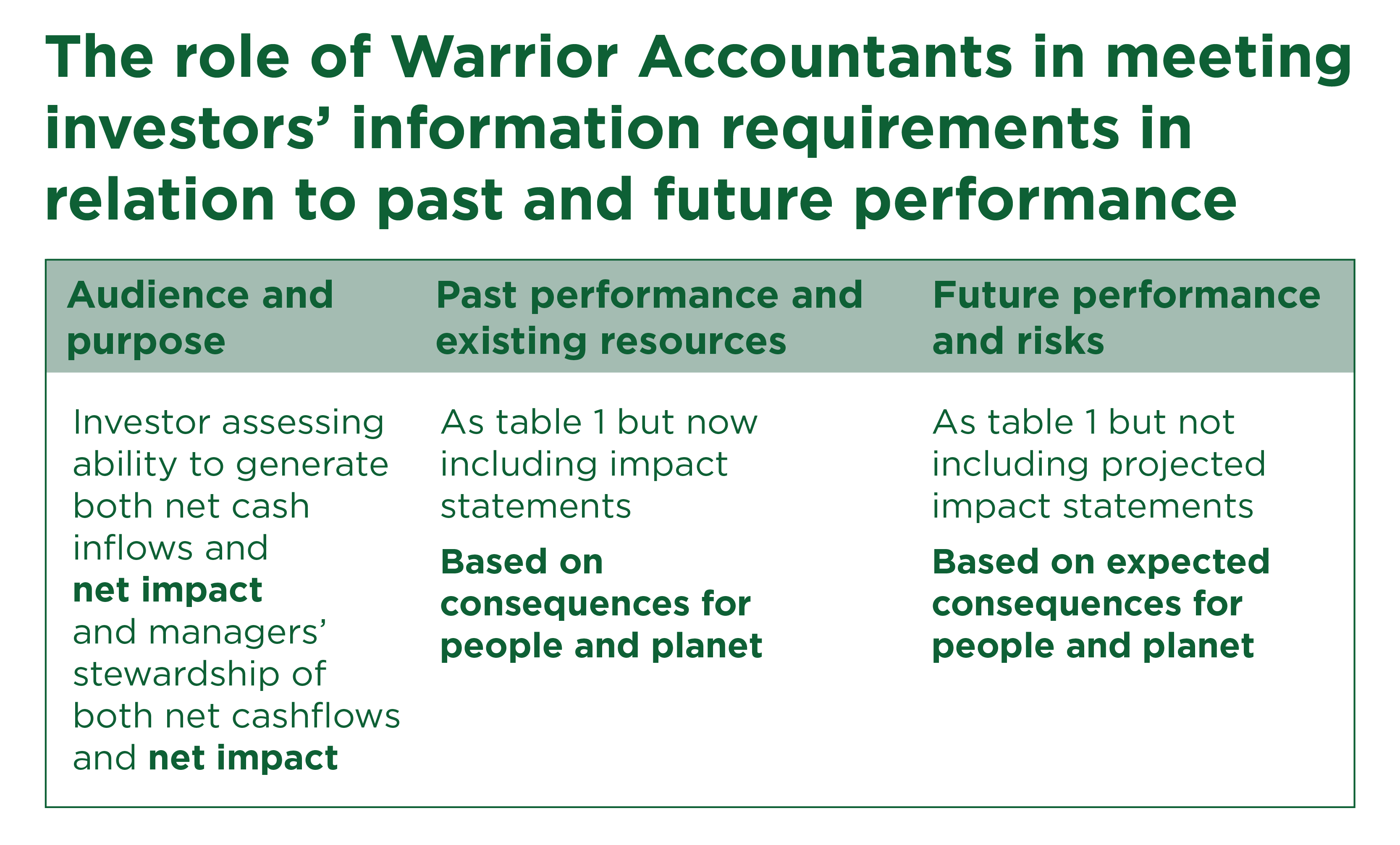

The IASBs Framework for the Preparation and Presentation of Financial Statements b. Convergence means developing high-quality standards in partnership with national standard-setters. Prosecute violators of their rules and guidelines so as to maintain the public trust and to ensure the efficient functioning of capital markets.

Accounting standard-setters such as International Accounting Standards Board use the following process in establishing accounting standards. B Discussion paper research exposure draft standard. Assure transparent and truthful reporting and guarantee the efficient functioning of the capital markets.

2 Verifiability is synonymous with objectivity and refers to the degree of statistical consensus among measurers. Every time a new accounting standard comes along that shouldnt drive a new auditing standard she said. The principles in the conceptual framework are designed to provide guidance and apply to a limited range of decisions relating to the preparation of financial reports while accounting standards apply to a wider range of decisions relating to the preparation of financial reports.

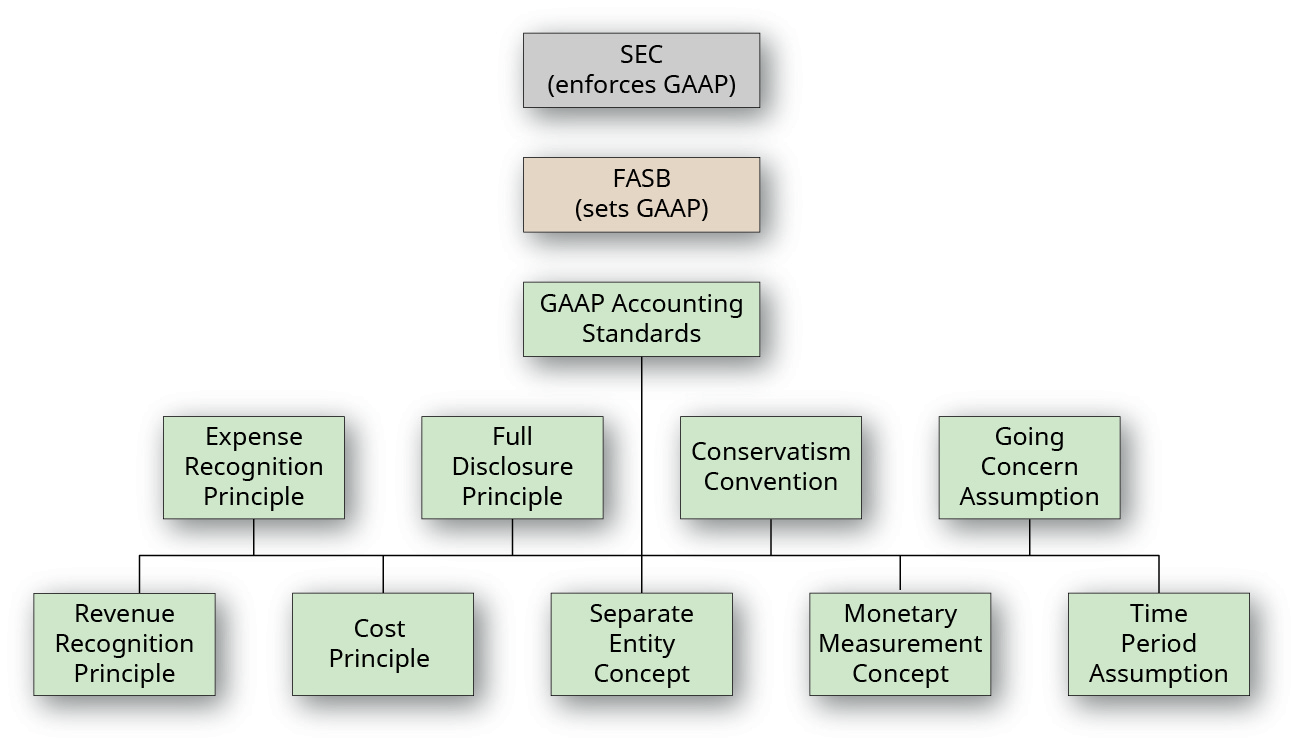

It is the official accounting standard setting body in the Philippines. Financial Reporting Standards Council FRSC c. CAP was first granted authority then the SEC then the Accounting Principles Board APB and now the Financial Accounting Standards Board FASB.

Accounting standard-setters and regulators Standard-setting bodies such as IASB and FASB are self-regulated private organizations that develop accounting standards. As a resultoption D is correct. Financial Reporting Standards Committee FRSC b.

Accounting Standards Council ASC. One of the things that was a driver for the revisions that we made to our estimates standard was the increasing use of accounting estimates that involve high levels of estimation uncertainty subjectivity judgment and complexity. When a new standard is envisagedrigorous research is undertakingfollowed by the call for.

Discussion paper research exposure draft standardc. Objectives of General Purpose Financial Reporting d. We have recently updated our website publishing platform resulting in a change to many URLs.

Standard-setters must give first priority to ensuring that companies do not suffer any adverse effect as a result of a new standard. Accounting Standards Committee ASC d. The Conceptual Framework provides the parameters within which the accounting standard- setters should work in crafting the financial accounting standards of the accountancy brofession 1 Point O All statements are true and I are true O and I are true 1 and il are true 54.

Research-discussion paper-exposure draft- standard. D Convergence means developing high-quality standards in partnership with national standard-setters. For example within the IASB Framework which is also the Australian Accounting Standards Board AASB Framework reference is made to users who are expected to have a reasonable knowledge of.

Government as Standard Setter. Since 1 January 2005 the Australian Accounting Standards Boards conceptual framework consists of. Regulating authorities such as the Securities and Exchange Commission SEC are government bodies who have the legal authority to enforce financial reporting requirements and adopt or establish accounting.

Protect investors and creditors.

Ch01 Eng Accounting Intermediate

Describe Principles Assumptions And Concepts Of Accounting And Their Relationship To Financial Statements Principles Of Accounting Volume 1 Financial Accounting

Will Accountants Save The World The Social Enterprise Magazine Pioneers Post

Standard Setting Bodies Fasb Sec Iasb Gaap Ch 1 P 2 Youtube

Qualitative Characteristics Of Accounting Information Overview Guide

Frequently Asked Questions Standard Setting In Canada

Accounting Informatory Specialists Will Support In Making Certain That Firms Will Meet Discovery Necessit Accounting Services Accounting Accounting And Finance

For Business Institutes Students Should Go Through Accounting Experts Assignment Help Uk Mba Student Teaching Grammar

Purpose Is The Reason Something Is Done Created Or Exists Much Of Our Primary Purpose For Self Work And Social Information Age Visionary Life Improvement

The Complete Guide To New Lease Accounting Standards Visual Lease

Ifrs Speech Accounting Standards And The Long Term

International Forum Of Accounting Standard Setters Ifass

On The Radar Looking Beyond The Revenue Standard Wsj

Regulators Publish New Global Revenue Accounting Standard Accounting International Accounting Revenue

Solved E As A Practical Matter Trade Offs Of Qualitative Chegg Com

Full Article Discussion Of Accounting For Intangible Assets Suggested Solutions

Comments

Post a Comment